Planning for Pension Season in Ireland 2025

By Rebecca Scaife

Published on: September 23, 2025

October is traditionally busy for pension planning, and the Irish pension landscape is evolving rapidly, with significant changes taking effect from next year.

Whether you’re just starting your career or approaching retirement, understanding these developments is a crucial part of your financial planning.

Understanding Your Pension Planning Profile

Pension planning is personal to everyone but broadly speaking there are three different approaches, depending on your income and level of wealth.

Understanding where you fit is key so you can take advantage of available opportunities.

Lower Income Earners

Lower income earners will generally need to prioritise housing costs over long-term savings, but significant help is on the way with auto-enrolment next year. Known as ‘My Future Fund’, the scheme will commence for eligible employees on 1st January 2026, ensuring that even if current finances are tight, you’ll begin building retirement savings automatically.

Mid-to-High Income Earners

Pension contributions represent one of Ireland’s most tax-efficient savings vehicles for middle to high earners.

Additional Voluntary Contributions (AVCs) allow you to contribute additional funds to your pension pot. They are flexible and you can vary contribution amounts based on your financial circumstances, make lump sum contributions when you have extra funds available, and backdate contributions to the previous tax year if made before the deadline.

As far as financially possible, making extra contributions to your PRSA or paying AVCs to your occupational scheme, allow you to maximise tax relief while building substantial retirement funds.

High Net Worth Individuals

Very high earners face unique opportunities and challenges. The gradual increase in the Standard Fund Threshold (SFT) provides more scope for pension accumulation, but good planning is essential for lump sum management and other retirement considerations.

Standard Fund Threshold Increase

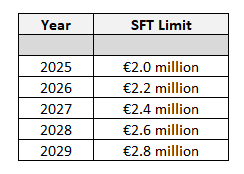

The Standard Fund Threshold (SFT) represents the maximum value your pension can reach while maintaining tax efficiency.

The threshold has remained static for a number of years but will begin a phased increase from 2026.

This structured increase gives high-value pension holders clear targets for planning optimal growth and withdrawal strategies.

Employer PRSA Contributions

As of January 2025, Personal Retirement Savings Account (PRSA) contributions from employers are capped at 100% of the employee’s annual salary. Anything above this will be taxed as a Benefit in Kind (BIK).

Take Action

Short Term Planning

- Calculate your current pension balance against SFT limits

- Determine optimal AVC contributions for 2024 backdating

- Review and rebalance your pension investment strategy

- Assess opportunities to direct bonuses into pension funds

Medium-Term Planning (Q1 2026)

- Understand Auto-Enrolment implications for your employees or employment

- Review PRSA contribution opportunities with your employer

Annual Reviews

- Monitor SFT compliance and growth projections

- Assess changing tax legislation impacts

- Review retirement timeline and withdrawal strategies if you’re within 10 years of retirement

Individual Approach

Every person’s pension journey is unique, shaped by earnings history, family circumstances, career trajectory and retirement aspirations. The above pension changes create opportunities but also add complexity to your financial planning. Decisions that you make now can significantly impact your retirement lifestyle in the future.