How Much Do I Need to Retire?

By Rebecca Scaife

Published on: April 16, 2024

Many people in Ireland worry that they won’t have enough money to retire, and research shows that these concerns are well founded.

According to the CSO the number of working people aged 25-69 that have a pension has increased to 66% in 2024. However, the average value of a pension pot in Ireland is still only €111,000.

This is far smaller than the nest egg people say they would like to have in retirement.

On the other end of the spectrum, we also meet people who will never possibly spend all of the wealth that they have accumulated in their lifetime. Sometimes the best advice is to start spending or giving your money away sooner rather than waiting until after your death.

How much money you need to retire will depend on you as an individual but today we’ll look at the areas we need to consider when planning for retirement and growing your pension fund.

How Much Income Will I Need in Retirement?

The maximum available contributory state pension amounting to €277.30 per week and is likely to fall short for many. Anyone who is relying solely on the state pension as their retirement plan will likely need to keep working beyond the ‘traditional’ retirement age or face a more frugal lifestyle than they are used to.

Research from Loughborough University describes three different models for retirement: a minimum standard, a moderate standard, and a reasonably comfortable standard.

Based on this research, the table below puts a numerical income level required per annum to meet each of the three standards. The figures are adjusted for inflation and net of all taxation.

| Standard of Retirement | One Person | Couple |

| Comfortable | €46,650 | €63,350 |

| Moderate | €30,970 | €42,800 |

| Minimum | €15,940 | €25,450 |

Standards of Living

Minimum and moderate standards aim to meet a ‘personal security’ level of living. However, they will fall short for many in terms of lifestyle security or leaving a legacy to your family.

A moderate standard will allow greater opportunities and choices for a retiree over the minimum standard. Plus, it will give a greater feeling of security and enjoyment.

A comfortable standard will give the greatest level of security and flexibility in retirement, granting more security and adaptability.

Spending Assumptions Throughout Retirement

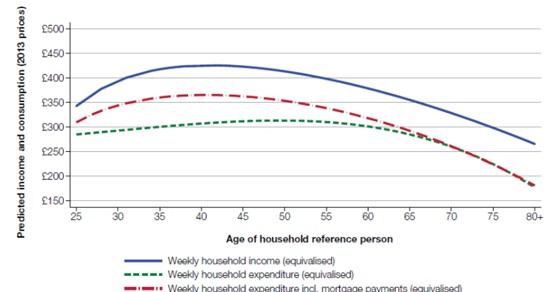

A pattern common over time to high- and low-income groups, is that spending in retirement generally starts higher and ends relatively lower.

While this intuitively makes sense to most people, recent data collected from the International Longevity Centre, shows that currently the rise and fall in spending is less sharp than we imagine.

“Our findings suggest that typical consumption in retirement does not follow a U-shaped path – consumption does not dramatically rise at the start of retirement or pick up towards the end of life to meet long-term care related expenditures.” – Dr. Brancati, International Longevity Centre.

Recent research from The Institute of Fiscal Studies shows that current total household spending per person remains relatively constant in real terms through retirement, increasing slightly up to around age eighty and remaining flat or falling thereafter.

In comparison to historic spending patterns, which indicated that consumption drops in retirement, this change is reflective of the ‘baby boomer’ generation who typically have better pension provision than previous generations.

With the changes in working patterns and less generous employer pension provision for the generations that follow, we anticipate a return to the historical patterns of spending.

The composition of spending also changes as people age. Food and motoring spend falls steadily while outgoings on household services (including home help and domestic cleaning) and household bills increased in later years. Spending on holidays increases up to age 80 and then decreases thereafter.

It’s also important to consider how the death of one member of a couple will affect outgoings. Shared expenditure, such as housing costs or the cost of running a car, will not half when a partner dies. Although, depending on your source of income in retirement your income may become significantly reduced.

Objectives in Retirement

The overwhelming requirement in retirement is that of a regular income to fund living expenses. Plus, enough to cover unexpected or large ad hoc expenses such as medical expenses, holidays, car replacements or house maintenance.

Going further than just establishing an income number can go a long way to managing our realistic expectations in retirement.

We believe that the most appropriate approach consists of dividing retirement spending into three discreet categories:

- Needs – basic non-discretionary expenditure to provide a baseline standard of living.

- Wants – discretionary expenditure to maintain your desired lifestyle.

- Wishes – luxuries that are not necessary to maintain your desired lifestyle.

This approach immediately creates a more solid framework against which to plan for future expenditure.

For example, I might want to go to the movies twice a week, but I don’t need to. I could equally borrow a book from the local public library for free or at the other extreme (luxury) install a home cinema system.

Framing our income requirements in this way helps to manage our retirement income journey and appreciate that from time to time, there may come a requirement to make some sacrifices.

A secondary yet important consideration for many of us is that of passing down a portion of our life savings to beneficiaries.

Why You Might Need More

It’s important to note that many underestimate their life expectancy. The average life expectancy is exactly that, there’s a 50% chance that you’ll live longer than you expected!

Life is unpredictable. From unexpected expenses to wanting to spoil your loved ones, having a little more in your pension pot offers security and peace of mind.

Lifestyle Security

Generally, in retirement you should aim for lifestyle security. That is, the level of income you would need to maintain your quality of lifestyle e.g. the car you drive, where you live, how many holidays you take each year.

For many people in retirement, it will prove impossible to maintain this standard of living by keeping money on deposit with a bank. The reason for this is that the average rate of return on deposits, after allowing for tax and inflation, has always tended to be close to zero.

Generally, people have different needs and require different strategies depending on their age. Pre-retirement should emphasise tax planning and capital accumulation. In early retirement the conversation switches to sustainable income strategies and maintaining lifestyle standards.

In late retirement, for those with enough accumulated wealth, the focus often shifts towards taking care of heirs, estate planning and even charitable bequests.

Making sure that you’re using the correct type of retirement and investment strategy is key.

Retirement planning should start decades before your planned retirement date and is an ongoing project, carried out in conjunction with your Financial Advisor.

Knowing that you have sufficient income to do all the things you both need and want to do in life without fear of ever running out of money is one of the key results of the financial planning process.

“If you realize that you have enough, you are truly rich” – Lao Tzu, Tao Te Ching.